VIVEPORT Payout Information Guide

To receive payments for your revenue earned on VIVEPORT platform, please set up your payout information. The instruction below will provide the detail information for you to fill out the payout information including your / your company’s contact, bank and tax information.

Information You Should Have Available

Contact Information

Individual

:

If you publish on Viveport as an individual developer, you need to provide your

-

-

Email address

-

Place of business address

-

Contact phone number

Company

:

If you publish on Viveport on behalf of a legally incorporated entity, you need to provide the following

-

-

Full company name (This

must

be your legal company name, matching other documentation)

-

Email address

-

Company address

-

Contact phone number

Bank Information

You need to provide detailed bank information including bank name, name on the account, account number / IBAN code, routing number and/or SWIFT code for Viveport to send your payments.

-

The name on the account must match the account holder name exactly as it appears on your bank statement.

-

In Europe and the UAE, please provide your IBAN code instead of bank account number.

Tax Information

You need to complete the contact information and a brief bank & tax questionnaire to determine your tax status. The required information and the questionnaire ask whether you publish on Viveport as an individual or a company, where you or your company is located and the selected distribution region/country of your Viveport-published titles.

-

US citizen / corporation must submit US tax form –

form W-9

.

-

For individual / corporation located outside US, you must submit US tax form –

form W-8BEN

for individual or

form W-8BEN_E

for

-

If you plan to publish your titles to Viveport China as an individual or a company located outside China, you must also submit China tax form (see Appendix D)

Setup Your Payout Information

Follow these steps to set up your payout information:

-

Sign in to the Viveport Developer Console at

developer.viveport.com

-

Click on

Settings

on the top menu.

-

Under Payout – Payout Information section, click

‘Setup Payout Information’

or

‘Edit.’

-

Note: If you need to pause during the setup process, click “Cancel” and then select “Save.” You can resume the form whenever you’re ready.

CONTACT INFORMATION

-

Select your account type – individual or company.

4a. If you are representing as an individual, please enter your:

-

-

Name

-

Birthday

-

Email address

-

Home or business address

-

Contact phone number

4b. If you are representing as a company, please enter the following information for the company:

-

-

Company name

-

Contact email address

-

Company address

-

Contact phone number

BANK & TAX QUESTIONS

-

Fill out the questionnaire to determine the bank and tax information required for payout.

5a. The region(s) you plan to publish your titles to:

-

-

Publish to Viveport Global store (except China)

-

Publish to Viveport China store

5b. Where you or your business are located.

Based on your feedbacks to the bank & tax questionnaire, you will need to fill out the following bank and tax information.

-

-

For an individual or a company based in the US, you must submit US tax form –

form W-9

.

-

For an individual and a company located outside US, you must submit US tax form –

form W-8BEN

as an individual or

form W-8BEN_E

as a corporation.

-

For an individual or a company based outside China and plans to publish in Viveport China store, you must submit China tax form (see Appendix D)

-

For an individual or a company based in the US and plans to publish in China, you must provide your bank’s SWIFT code. For other developers, SWIFT code is required no matter where your titles are being published.

BANK INFORMATION

-

Enter your or your company’s bank account information as follows:

|

Field

|

Expected Input

|

Example

|

|

Bank location

|

Only English characters are accepted

|

United States

|

|

Currency

|

The payout currency is auto selected per your bank location selection.

|

USD

|

|

Name on bank account

|

Only English characters are accepted.

This should be the name of the bank account holder exactly as it appears on your or your company’s bank statement.

|

John Smith

|

|

Bank name

|

Only English characters are accepted.

|

Bank of America

|

|

Account number or IBAN code

|

Account number should only consist of numbers.

IBAN code consists of a country code, two numbers, and up to thirty alphanumeric characters.

In Europe and UAE, please provide IBAN code instead of bank account number.

|

123456789876

ES1234567898732123456

|

|

Bank Routing

|

Your bank’s routing number should be 9 numbers.

(Known as an ABA routing transit number in the US; routing number in Canada.)

|

123456789

|

|

SWIFT code

|

For US-based developer, your bank’s SWIFT code is required if you plan to publish titles in China store. For other developers, SWIFT code is required no matter where your titles are being published.

The SWIFT code is 8 or 11 characters:

-4 letter bank code

-2 letter country code

-2 letter location code

-3 letter branch code (optional)

Look up your bank’s SWIFT code

here

or

here

.

|

BOFAVN8X

|

|

Sub-branch name

|

For bank in China, please provide sub-branch name in both English and Chinese.

In case if your account was created in a branch in stead of sub-branch (not have sub-branch information), please fill in your branch name instead.

|

Hudonglu sub-branch

湖東路支行

|

TAX INFORMATION

-

Fill out the required tax forms and click

‘Next.

‘

-

-

Depending on your answers on the Tax & Bank Questions, you will be asked to fill out the following tax forms.

-

For individual:

|

Country of Citizenship

|

Publish titles to Viveport

Global

|

Publish titles to Viveport China

|

Publish titles to both Global & China

|

|

US

|

W9

|

W9

China tax form

|

W9

China tax form

|

|

China

|

W-8BEN

|

W-8BEN

ID document

|

W-8BEN

ID Document

|

|

Others

|

W-8BEN

|

W-8BEN

China tax form

|

W-8BEN

China tax form

|

|

Country of Company

|

Publish titles to Viveport

Global

|

Publish titles to Viveport China

|

Publish titles to both Global & China

|

|

US

|

W9

|

W9

China tax form

|

W9

China tax form

|

|

China

|

W-8BEN_E

|

W-8BEN_E

|

W-8BEN_E

|

|

Others

|

W-8BEN_E

|

W-8BEN_E

China tax form

|

W-8BEN_E

China tax form

|

If you need further support with the tax forms, please see appendix.

REVIEW & SUBMIT

-

Click ‘Next’ to advance onto the Review & Submit page.

-

Check your info again and confirm that everything is correct. Then click ’

Submit

.’

Your bank information will be reviewed as quickly as possible (usually 5 business days). You’ll receive an email when it’s been verified successfully or to explain why it was rejected. You can also check verification status under Payout – payout Information in Settings. If you have further questions, we’ll be happy to help! Please visit

Viveport Developer Console

and ask your question via Help Center by clicking the question mark icon on the top right comer.

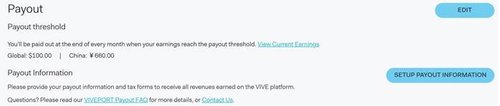

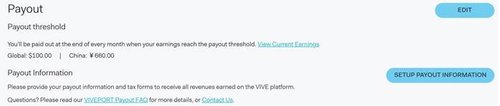

PAYOUT THRESHOLD

10. You can set up your payout threshold on developer console via the link

https://developer.viveport.com/console/settings

You will be paid out at the end of every month when your earnings reach the payout threshold. Please note that if the threshold is below $250 USD, we will deduct $25 USD wire transfer fee per payout transaction.

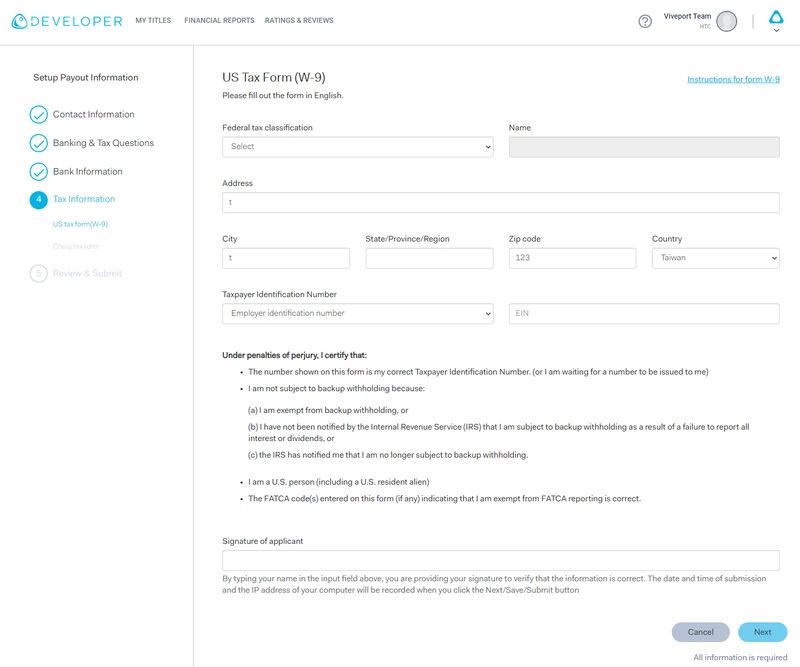

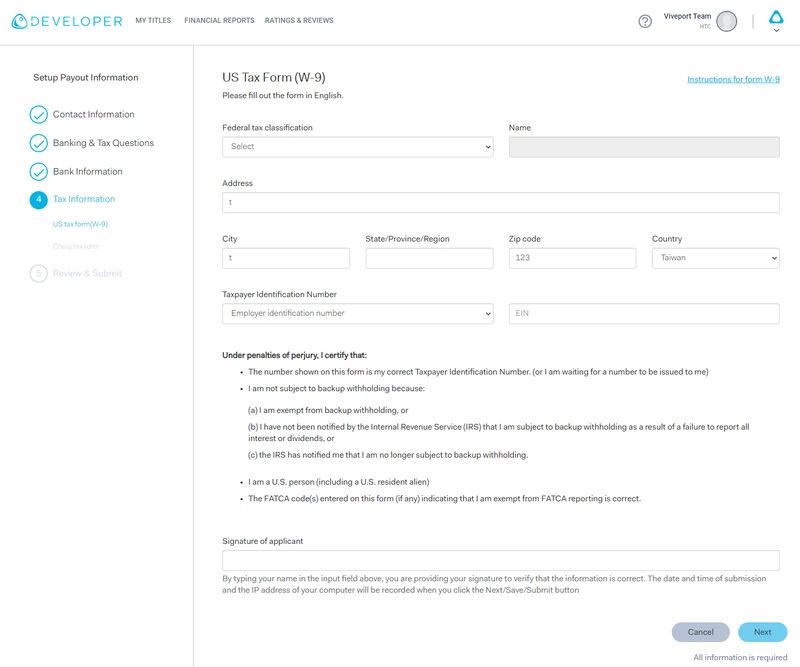

Appendix A: US tax form (W-9)

For US based individual or company must submit US tax form –

form W-9

.

Name

The name on the tax form should be the same as the one you provided in Bank Information section.

Address

Enter your permanent residence address.

Tax Identification Number

-

If you are an individual or sole proprietor and file your tax return using your Social Security Number (SSN), please enter your Social Security Number (SSN).

-

For corporations, partnerships, or LLCs, please provide the federal Employer Identification Number (EIN).

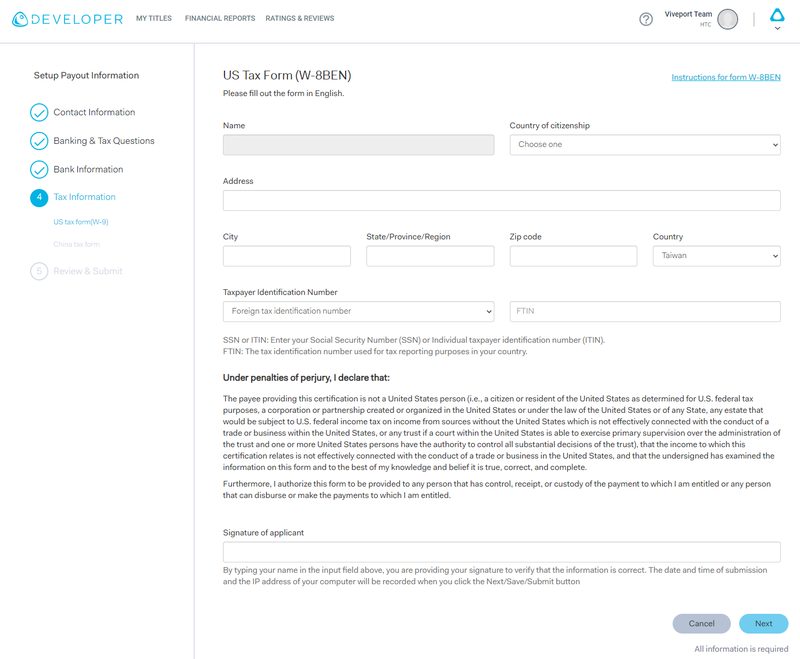

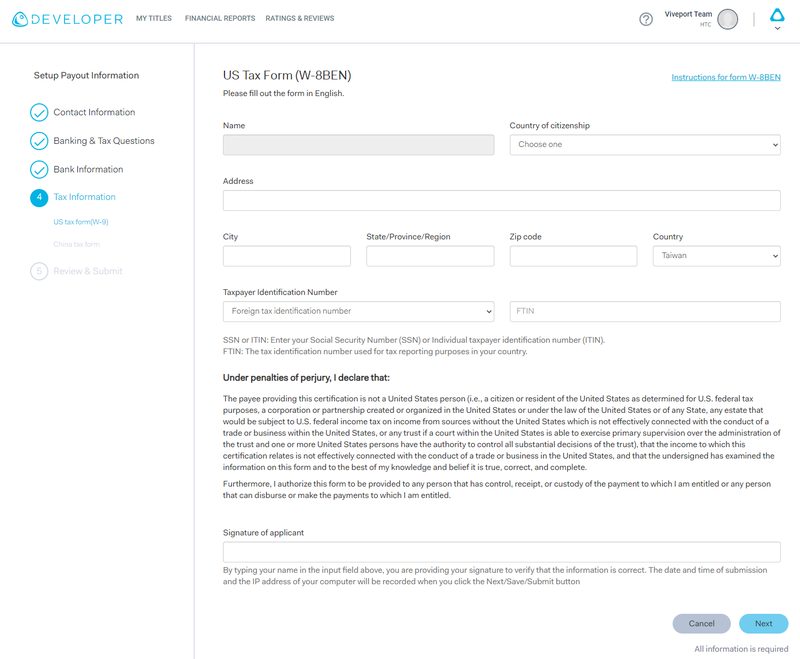

Appendix B: US tax form (W-8BEN)

For individuals located outside of US, you must submit US tax form –

form W-8BEN

.

Name

The name on the tax form should be the same as the one you provided in Bank Information section.

Country of Citizenship

Choose the country of your citizenship from the drop-down menu.

Address

Your permanent residence address is the address in the country where you claim to be a resident for purpose of that country’s income tax.

Tax Identification Number ( Foreign Tax Identification Number or US Taxpayer Identification Number)

Enter your Social Security Number (SSN) or Individual taxpayer identification number (ITIN) if you have one.

Foreign Tax Identifying Number (FTIN) is the tax identification number used for tax reporting purposes in your country. You must provide your FTIN if you don’t have SSN / ITIN.

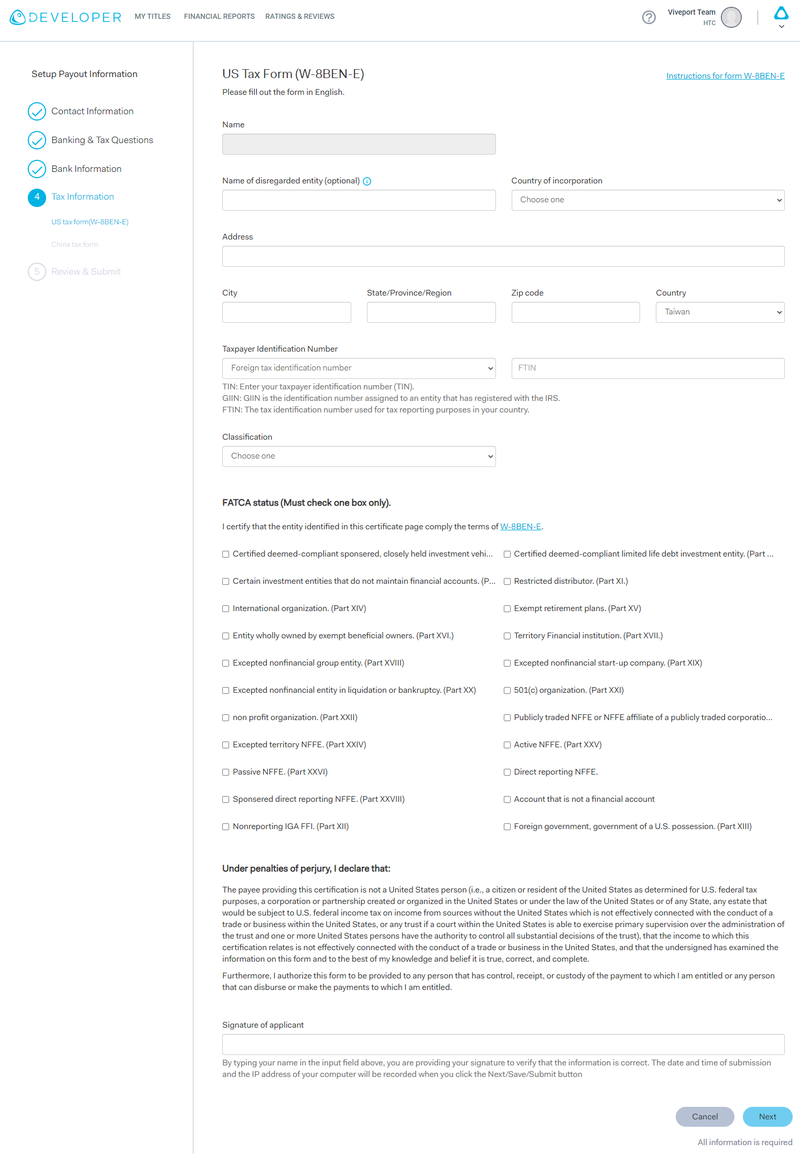

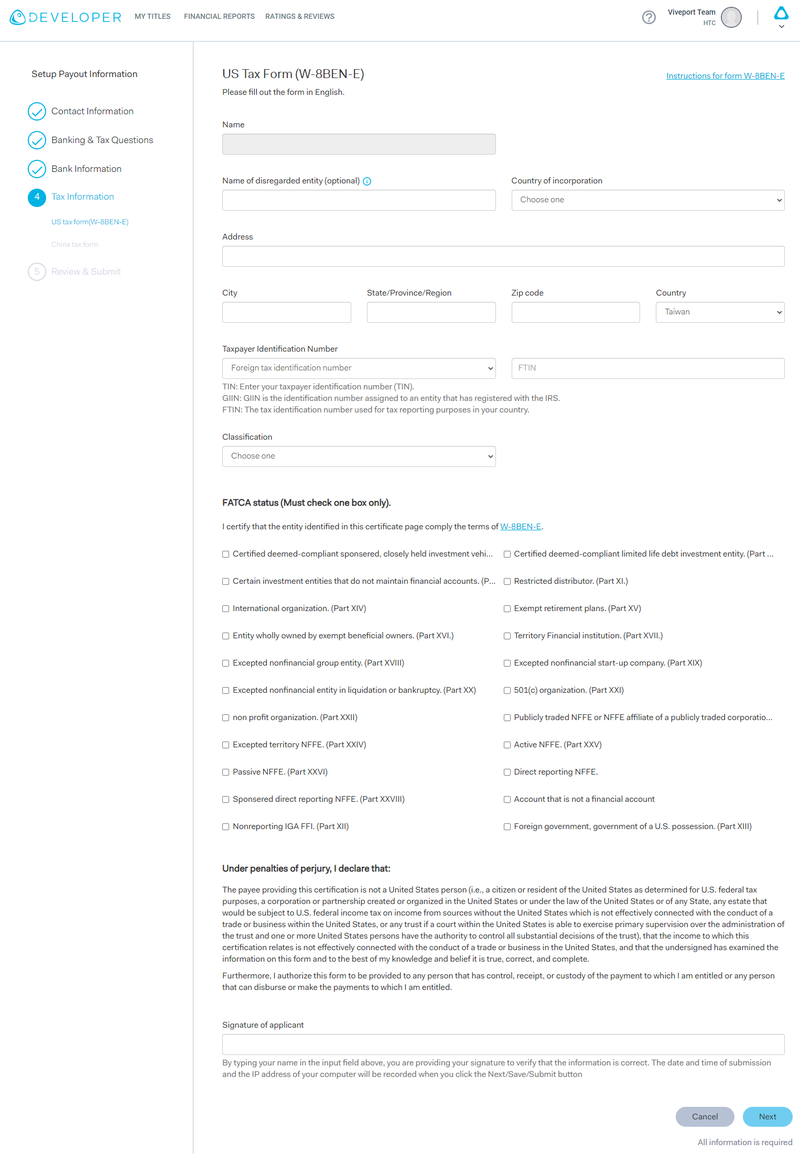

Appendix C: US tax form (W-8BEN_E)

For corporation located outside of US, you must submit US tax form –

form W-8BEN_E

.

Name

The name on the tax form should be the same as the one you provided in Bank Information section.

Country of Incorporation

Choose the country where your company is located from the drop-down menu.

Name of Disregarded Entity – optional

A disregarded entity is a business entity that is separate from its owner but which elects to be disregarded as separate from the business owner for federal tax purposes. If you are a disregarded entity receiving a withholdable payment, please enter your name.

Address

Enter the permanent residence address of your company.

Tax Identification Number (US Taxpayer Identification Number, Foreign Tax Identification Number , or Global Intermediary Identification Number)

Enter your US taxpayer identification number (TIN) if you have one.

A Global Intermediary Identification Number (GIIN) is the identification number assigned to an entity that has registered with the IRS. Enter your GIIN if you have one.

Foreign Tax Identifying Number (FTIN) is the tax identification number used for tax reporting purposes in your country. You must provide your FTIN if you don’t have an US TIN or GIIN.

Classification

Choose your business entity type from the drop-down menu.

FATCA Status

FATCA is intended to increase transparency for the Internal Revenue Service (IRS) with respect to US persons that may be investing and earning income through non-US institutions. While the primary goal is to gain information about US persons, FATCA imposes tax withholding where the applicable documentation and reporting requirements are not met.

Choose one box that applies to your entity type.

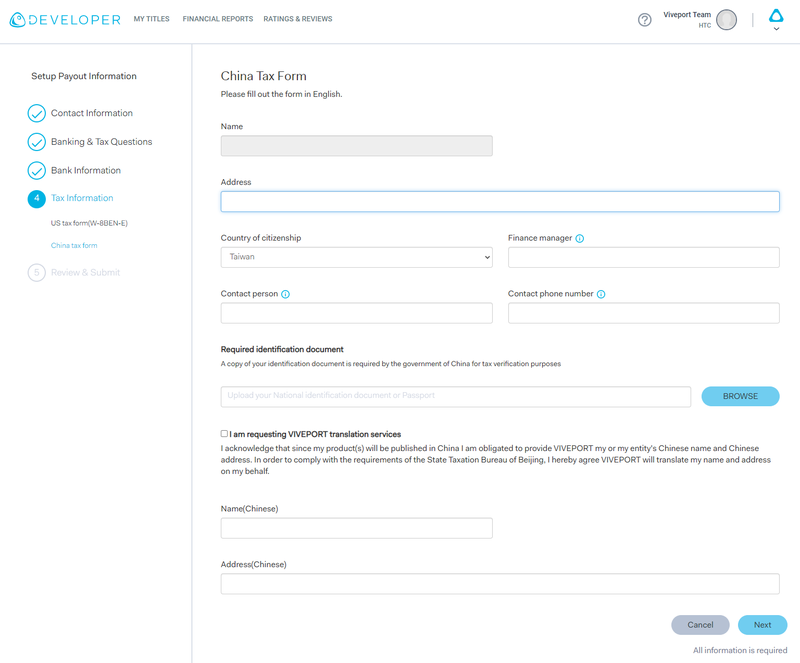

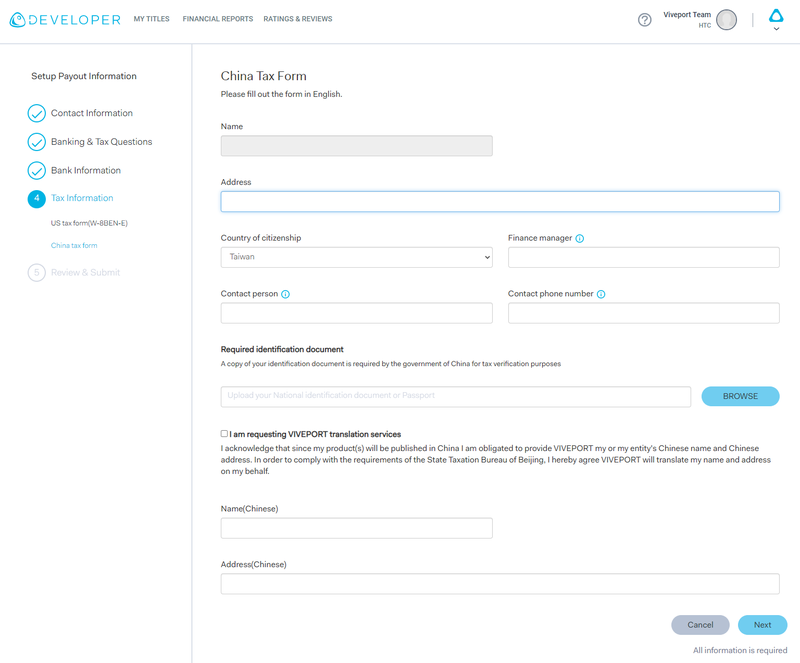

Appendix D: Chinese tax form

For individual or company outside China, if you plan to publish titles to Viveport China store, you must also submit Chinese tax forms.

Name (English)

The name on the tax form should be the same as the one you provided in Bank Information section.

Address (English)

-

For individual, please enter the address in the country where you claim to be a resident for purpose of that country’s income tax.

-

For corporation, partnership, or LLC, please enter the permanent residence address of your company.

Country

-

For individual, please choose the country of your citizenship from the drop-down menu.

-

For corporation, partnership, or LLC, please choose the country where your company is located from the drop-down menu.

Finance Manager

-

If you are an individual, please enter your name.

-

For corporations, partnerships, or LLCs, please enter the name of CEO or highest supervising member and this can be the same as contact person.

Contact Person

Enter the name of the contact person.

Phone Number

Enter the phone number of the contact person that can be reached.

ID Document Type

China government requires a copy of your identification document for tax verification purposes.

Name and Address (Chinese)

If you do not have Chinese name or address, you can request for VIVEPORT translation services to provide the Chinese translation for your / your company name and address on your behalf.